| TMS: 029-00-01-173 Owner Information:

Owner Occupied Property: No Homestead Exempt (Age 65+ or Disability): No | Council District: C7 Fire District: F22 Tax District: T06 TIS Zone: 5 Jurisdiction: 1P Acres: 4.51 Lots: 0.0 |

Neighborhood: D110 - CROSS AREA (EAST) Appraiser ID: RS Lot: Block: Section: Zoning: Berkeley County - Flex1 Parent TMS: 029-00-01-005 Notes:SEP TMS # 029-00-01-173 (4.51 AC) FROM 029-00-01-005, WAS 9.02 (NOW 4.51 AC) NO CURRENT PLAT ON FILE SO AC WAS DIVIED EVENLY BETWEEN BOTH No'S. TMS 029-00-01-005 HAS BEEN DIVIDED MULTIPLE TIMES, ORGINAL AC WAS 12.54, HOWEVER, THIS IS NOT THE CURRENT ACREAGE THAT IS LISTED IN (REC BK 2669/820). DUE TO PARCEL BEING COMPLETELY SEP BY 2 OTHER PARCELS IN BETWEEN, OFFICE POLICY IS TO SPLIT/ ADD NEW TMS # FOR THE NONE ATTACHED PIECE. |

| Site addresses: | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2184 OLD HIGHWAY 6 CROSS, SC 29436, Unit/Lot: | 2178 OLD HIGHWAY 6 CROSS, SC 29436, Unit/Lot: A | 2178 OLD HIGHWAY 6 CROSS, SC 29436, Unit/Lot: B | 2180 OLD HIGHWAY 6 CROSS, SC 29436, Unit/Lot: | ||||||

| Owner: DINGLE WILHELMINA | Sale Date: 02/01/2018 | Sale Price: $5.00 | Deed Book-Page: 2669 - 820 | Plat: | Transfer Notes: |

| Owner: DINGLE FRANK (DOD) | Sale Date: 02/28/2006 | Sale Price: $0.00 | Deed Book-Page: 5440 - 0216 | Plat: CAB O - 39B | Transfer Notes: |

| Owner: DINGLE WILLIAM | Sale Date: 11/16/1971 | Sale Price: $1.00 | Deed Book-Page: A231 - 0157 | Plat: | Transfer Notes: |

| Tax Year | Receipt # | Tax District | Original Total | Total With Penalties (if applicable) | Pay Date | Pay Type | Delinquent | Taxed Value | Owner Occupied (4% QR Rate) |

|---|---|---|---|---|---|---|---|---|---|

| 2023 | 0044727 | 6 | $3,002.33 | $3,406.09 | Unpaid | Yes | $179,700 | No | |

| 2022 | 0036955 | 6 | $3,137.90 | $3,415.59 | 02/07/2023 | Paid | No | $179,700 | No |

| 2021 | 0035674 | 6 | $3,160.72 | $3,725.68 | 10/24/2022 | Landsale | Yes | $179,700 | No |

| 2020 | 0036918 | 6 | $3,172.40 | $3,172.40 | 01/15/2021 | Paid | No | $179,700 | No |

| 2019 | 0036159 | 6 | $3,165.93 | $3,636.67 | 10/16/2020 | Paid | Yes | $179,700 | No |

| Last Sale Date: 02/01/2018 Recording Date: 02/05/2018 Sale Price: $5.00 | Plat Information: Deed Book: 2669 Deed Page: 820 | Sales Validity: 2A Validity Other: |

| Building Market: 136,700 Land Market: 43,000 | Building Taxable (4% Res): 0 Building Taxable (6% Other): 136,700 Building Taxable (4% Ag): 0 Building Taxable (6% Ag): 0 | Land Taxable (4% Res): 0 Land Taxable (6% Other): 43,000 Land Taxable (4% Ag): 0 Land Taxable (6% Ag): 0 |

| Total Taxable Value: 179,700 Total Assessment: 10,780 | ||

| Fee Name | Fee Amount |

|---|---|

| Fire Fee | 485 |

| Land Fill Fee | 225 |

| Stormwater Utility Fee | 108 |

| Building Count: 3 Residence Count: 0 | Yard Item Count: 0 Mobile Homes on Property: 0 |

| Sub Area | Sub Area Description | Sketched Area (SqFt) |

|---|---|---|

| APOR | Porch | 90.0 |

| APOR | Porch | 143.0 |

| ASPO | Screen Porch | 108.0 |

| APOR | Porch | 120.0 |

| AFFL | 1st Floor | 3349.0 |

| Building Total Finished SQFT: 3349.0 | ||

| Sub Area | Sub Area Description | Sketched Area (SqFt) |

|---|---|---|

| AFFL | 1st Floor | 519.0 |

| Building Total Finished SQFT: 519.0 | ||

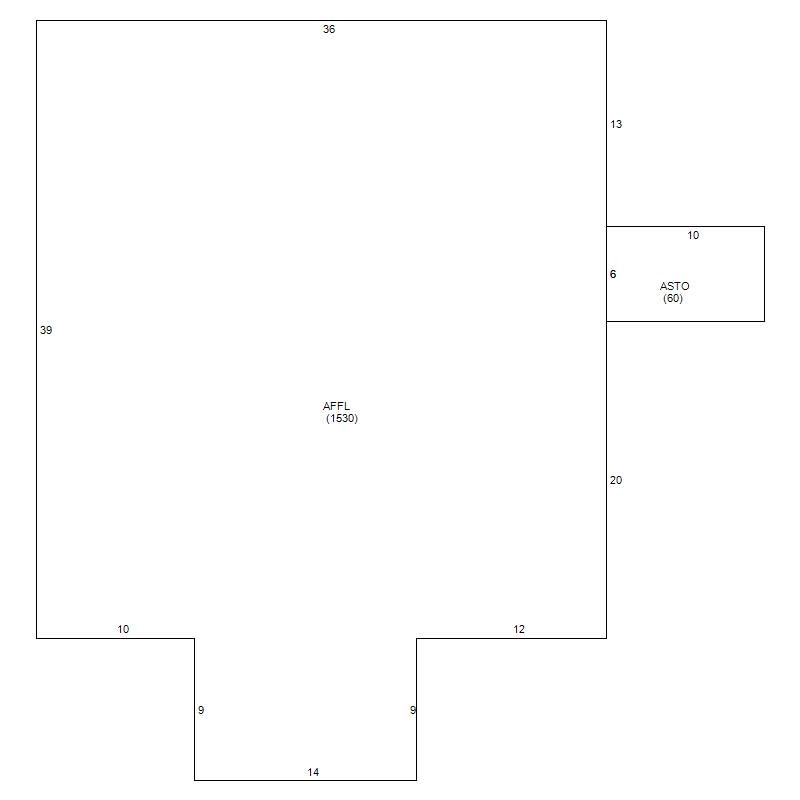

| Sub Area | Sub Area Description | Sketched Area (SqFt) |

|---|---|---|

| AFFL | 1st Floor | 1530.0 |

| ASTO | Storage | 60.0 |

| Building Total Finished SQFT: 1530.0 | ||