On July 28, 2014, Berkeley County Council adopted a Stormwater Management Utility Ordinance (Ordinance No. 14-07-021) that established an interim Stormwater Utility Fee and tasked the County to determine the amount of impervious areas associated with the development of a Permanent Stormwater Management Utility Fee and Classification system.

On May 29,2018, Berkeley County Council adopted an amendment to the Stormwater Management Utility Ordinance (Ordinance No. 18-05-21) that established a permanent Stormwater Utility Fee via an assessment of impervious surface areas. A copy of the original and amended Stormwater Management Utility Ordinances are posted on this page. Furthermore, the Permanent Stormwater Utility Rate Study Report conducted via the assessment of impervious surface areas is posted on this page. It was discovered through the Permanent Stormwater Utility Rate Study Report that 2,760 ft2 of impervious area is the equivalent of a residential unit (ERU).

Affected property owners of Berkeley County are notified of the new fee in their October 2018 annual Tax Notice. The fee and amount of the fee is listed as Stormwater Utility Fee on the Tax Notice.

- Original Stormwater Management Utility Ordinance (Ordinance No. 14-07-021)

- Amended Stormwater Management Utility Ordinance (Ordinance No. 18-05-21)

- Berkeley County Permanent Stormwater Utility Rate Study Report

- National Pollutant Discharge Elimination System (NPDES) General Permit for Storm Water Discharges from Regulated Small Municipal Separate Storm Sewer Systems (MS4 Permit)

Below is a list of frequently asked questions regarding the Stormwater Utility Fee.

Please contact Berkeley County Stormwater Management Program at (843) 719-4195 or email at vog.csytnuocyelekreb@pmwsbew on stormwater related questions.

Stormwater Utility Fee | Information | Form | eForm |

| Stormwater Utility Fee Credit & Appeals Manual | |||

| Stormwater Utility Fee Appeal Form (Appendix A) (Address Change) | |||

| Stormwater Utility Fee Credit Application Form (Appendix A) (Address Change) | |||

| Stormwater Utility Fee Reallocation Application (Appendix A) (Address Change) | |||

| Stormwater Utility Fee Credit Renewal Form (Appendix B) (Address Change) | |||

| Right-Of-Entry Agreement (Appendix C) | |||

| Maintenance Covenant (Appendix D) | |||

| Clemson Extension Service Rain Garden Manual (Appendix E) | |||

| SCDHEC Stormwater Management BMP Manual (Appendix F) | |||

| Clemson Extension Service Education Programs (Appendix H) |

What is a Stormwater Utility Fee and where is it applicable?

It is an annual fee assessed on the developed properties in the unincorporated area of Berkeley County, City of Goose Creek, and City of Hanahan (via Inter-Governmental Agreements) to fund the County’s, Goose Creek’s, Hanahan’s, and the Town of St. Stephen’s Stormwater Management Program (SWMP) and to comply with the regulatory requirements of each respective entities MS4 Permit.

Why does the County have a Stormwater Management Program?

Under the federal Clean Water Act, the Environmental Protection Agency (EPA) and South Carolina Department of Health and Environmental Control (SCDHEC) rules and regulations mandate Berkeley County to comply with the MS4 Permit. The MS4 Permit requires the County to develop, implement, and enforce a Stormwater Management Program to reduce the discharge of pollutants from Berkeley County’s MS4 to the maximum extent practicable (MEP), to protect water quality, and to satisfy the appropriate water quality requirements of the Clean Water Act. Additionally, Berkeley County signed Inter-Governmental Agreements with the City of Goose Creek and the City of Hanahan that require the County to develop, implement, and enforce a Stormwater Management Program within each respective municipality.

What does the Stormwater Management Program do?

Berkeley County’s Stormwater Management Program is responsible for all stormwater related activities such as construction and post construction inspections, storm sewer mapping, illicit discharge detection and elimination, water quality monitoring, sampling, and tracking, and other SWMP tasks required by the MS4 Permit. The goals of the program are to protect, maintain, and enhance water quality and the environment of the County, Goose Creek, and Hanahan as well as the short-term and long-term public health, safety, and general welfare of the citizens of the County, Goose Creek, and Hanahan.

How is the fee assessed?

Stormwater Utility Fee is assessed based on the funding required to implement the SWMP in the County, Goose Creek, and Hanahan. Each year as part of the annual budget process, costs and revenues will be reviewed and adjusted to ensure a balance in SWMP funding. A Stormwater Management Utility Rate Study was performed to establish permanent stormwater utility fees and classifications. The permanent fee schedule will be based on the amount of impervious area a developed non-residential parcel contains. Section 7 of the amended Ordinance describes the permanent fee and classification system.

What is impervious surface?

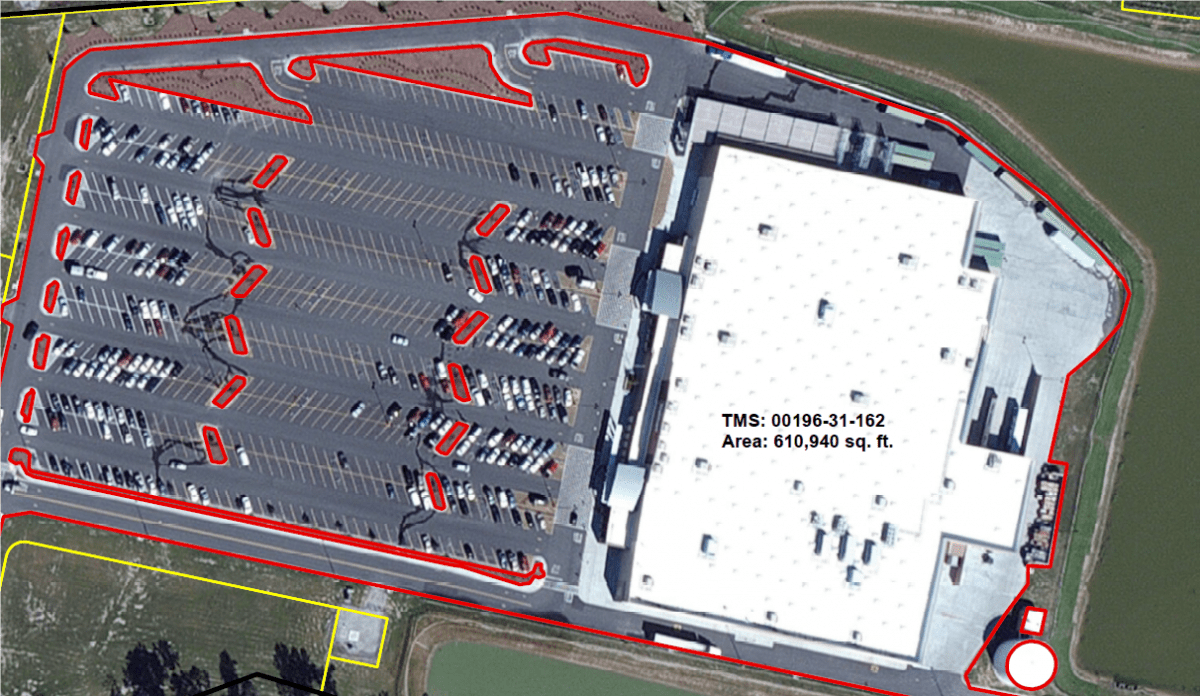

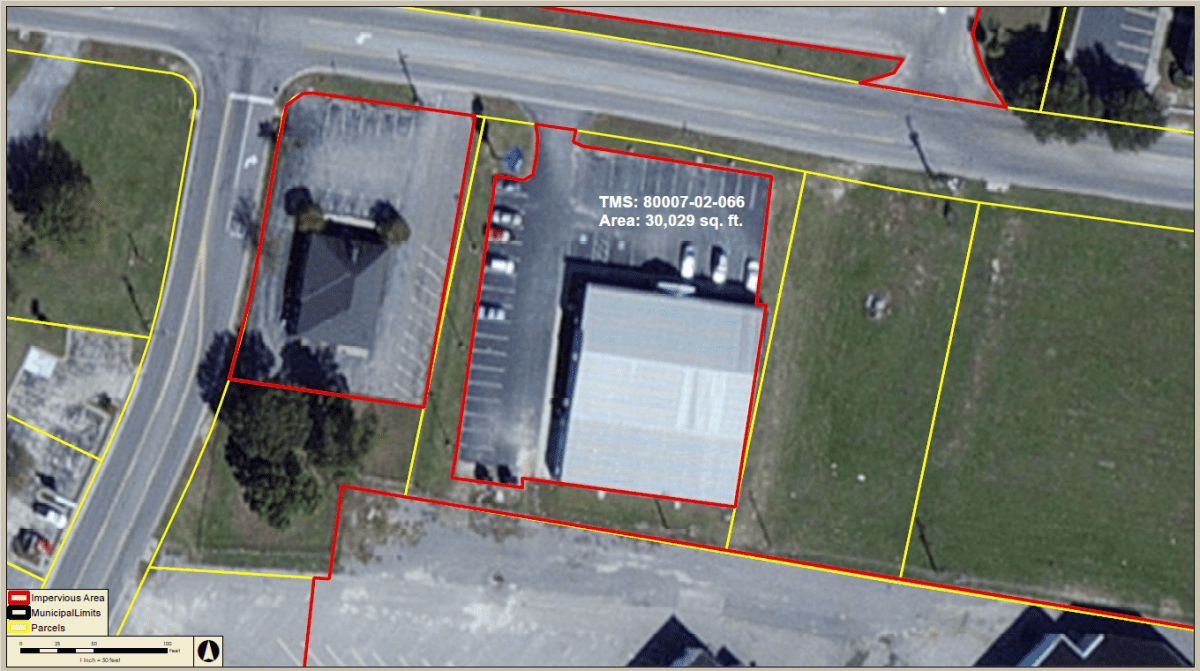

An area modified to the extent that natural infiltration into the natural soil has become impeded. Impervious surfaces are accounted for in private walkways, parking lots, driveways, rooftops, patios, sheds, etc. Below are examples of impervious surface.

Who will be charged this fee?

All developed properties in the unincorporated area of Berkeley County, the City of Goose Creek, and the City of Hanahan, including properties containing single and multifamily residences, mobile homes, nonresidential (commercial or industrial) land uses, tax exempt and non-profit properties are charged with a Stormwater Utility Fee. The fee will not be imposed on agricultural lands, forestlands, or undeveloped lands.

The established average impervious surface area associated with single-family residential (SFR) properties will be assessed at 1 ERU and applied uniformly to all mobile home units and SFR units.

Non-residential properties will be assessed in multiples of ERUs based on actual impervious areas (subject to a 1 ERU minimum). This category of properties includes the following properties classified as:

- Commercial Property

- Industrial Property

- Institutional Property

- HOA Community Center Property

- Multi-Family to include Duplexes and townhomes not subdivided by parcel lines

- Tax-exempt and Non-profit

- Boat Slips (Dry Stack Marinas)

- Properties whose primary function is not a single-family residence

Common areas associated with mobile home parks, multi-family and single-family residential development will be assessed like non-residential properties and charged to the HOA or property management.

Do churches, schools and non-profit organizations have to pay the fee?

Yes, churches, schools, and non-profit organizations will pay a Stormwater Utility Fee.

How much is the Permanent Stormwater Utility Fee and how is it calculated for me?

The following table shows the annual fee, devised via a Stormwater Management Utility Rate Study. The study employs an impervious surface model utilizing, impervious ft2 ÷ 2,760 ft2/(ERU Fee) calculation, with modifiers and variables for agricultural land, forested land, and undeveloped land.

Example: A parcel containing 915,447 ft2 (21.01 ac.) of impervious surface

915,447 ft2 ÷ 2,760 ft2 / ERU = 331.68 (rounded to nearest ERU = 332 ERU) 332 ERU x $36.00 / ERU = $11,952/year

| Property Class | Base ERU |

| Single Family Residential | 1 ERU/Unit |

| Nonresidential (Commercial/Industrial) | Impervious ft2 ÷ 2,760 ft2/ (ERU Fee) |

| Multi-family | Impervious ft2 ÷ 2,760 ft2/ (ERU Fee) |

| Mobile Homes | 1 ERU/Unit |

| Tax-exempt and Non-profit | Impervious ft2 ÷ 2,760 ft2/ (ERU Fee) |

| Vacant/Undeveloped | Not Assessed |

| Monthly ERU Fee | $3.00 |

| Annual ERU Fee | $36.00 |

| *for parcels containing multiple residences on the parcel, an annual fee per unit will be assessed | |

Do other communities have a Stormwater Utility Fee?

Yes, most communities in the coastal area have instituted a Stormwater Utility Fee including Charleston County, Dorchester County, City of Folly Beach, City of Isle of Palms, Town of James Island, Town of Lincolnville, Town of Sullivan’s Island, Town of Mount Pleasant, City of Charleston, City of North Charleston, Town of Summerville, Beaufort County, Town of Hilton Head, Georgetown County, Horry County, City of Conway, City of Myrtle Beach, and City of North Myrtle Beach.

Can the fee be appealed?

Yes, the Stormwater Utility Fee can be appealed within thirty days of the mailing of the Tax Notice. The appeal procedure is explained in Section 13 of the amended Ordinance and within the Berkeley County Stormwater Utility Fee Credit & Appeals Manual. Please see the below link, Stormwater Utility Fee Credits & Appeals.